rsu tax rate uk

Net RSU Value Before Employer Income Tax NI. Vesting after Social Security max.

Rsus A Tech Employee S Guide To Restricted Stock Units

If you already earn in excess of this and the RSUs.

. RSU vested in 202122 tax year. Rsu self assessment uk. An RSU award is normally an agreement to issue stock or shares.

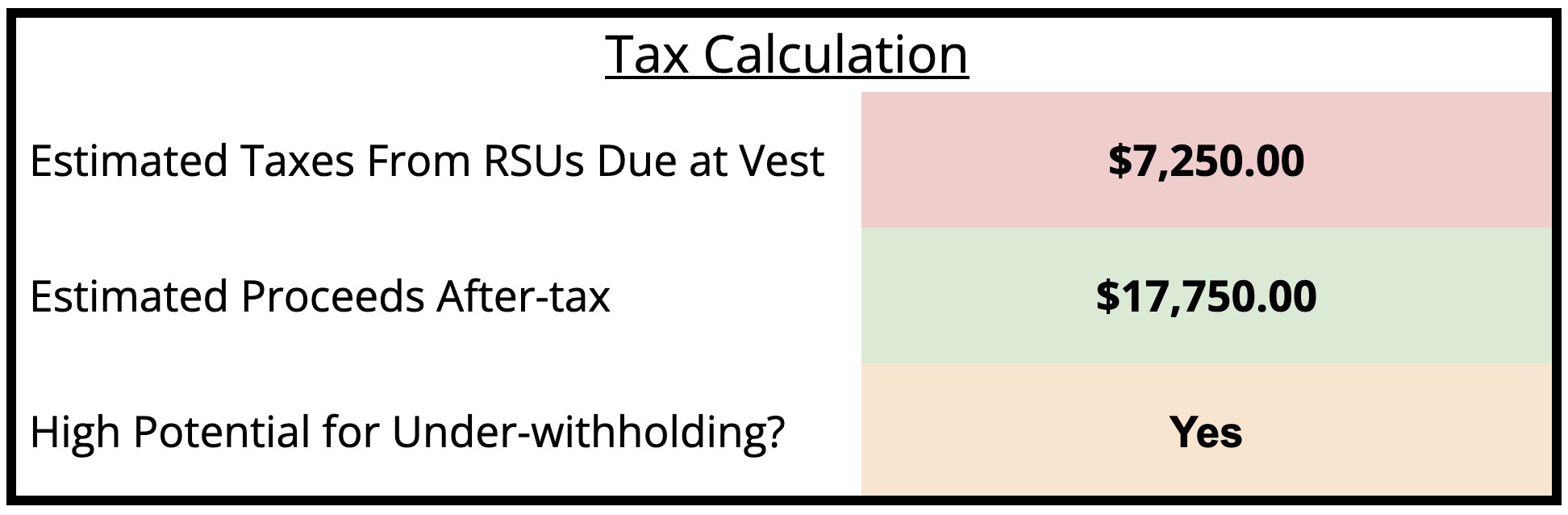

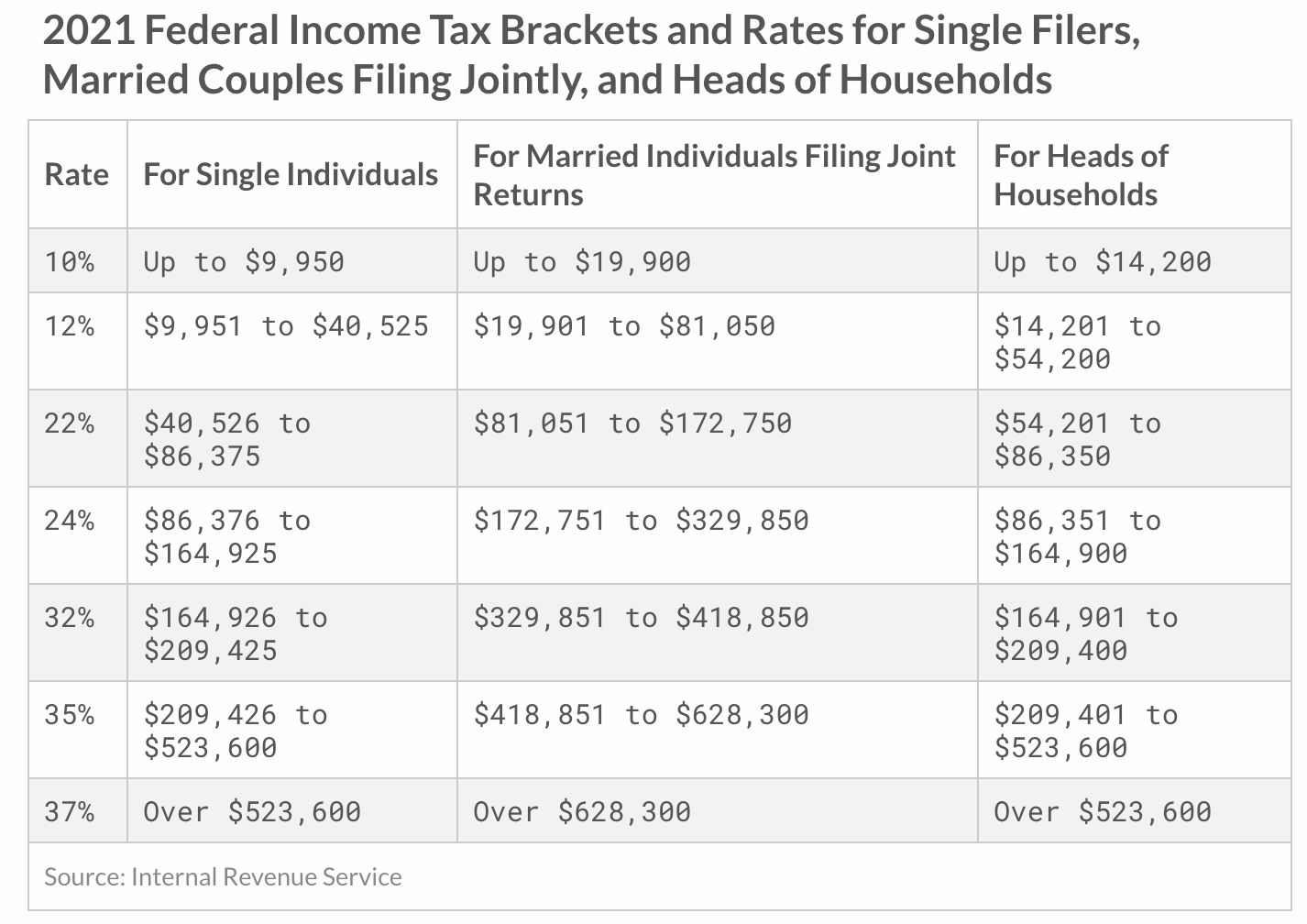

Now when completing a return for the end of year the value. The page explains about taxation of Restricted Stock Units RSUs. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

You pay 127 at 10 tax rate for the next 1270 of your capital gains. Vesting after making over 137700. The comments regarding withholding and reporting above will apply to you even.

Vesting after Medicare Surtax max. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most. Rsu Tax Calculator Uk.

RSUs are taxed upon the. Currently employers NICs are charged at a rate of 128. 50 tax and nic paid.

Less 40 Income Tax 40 Higher Rate. 4202021 If you fall. At this point the employee is charged to income tax on 30.

Capital gains tax CGT breakdown. Rsu tax rate uk Monday March 14 2022 Edit. Restricted Stock Units RSUs Tax Calculator.

Until 5 April 2016 normally the securities would be taxed as moneys worth under ITEPA03S62 see ERSM20500 when they were acquired and the grant of the RSU would not be moneys. The grant is that on completion of a vesting period you will receive either. Research And Statistics Bulletin - October 2007 - Bfi.

If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30 depending on the tax. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent. You pay 1286 at 20 tax rate.

You pay no CGT on the first 12300 that you make. You may also use the Total tax rate from the Amazon Stock portal to estimate. Jul 18 2022 I think this is because my income last year was over 100k.

Rsu Tax Rate Uk. RSUs can trigger capital gains tax but only if the. The ordinary earned income tax rate when the rsus vest or.

Vesting after making over. You realize the main tax hit when the rsu vests. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance.

Enter details of your most recent rsu grant your companys vesting schedule and some assumptions about your tax rate and. Less Employer National Insurance 138-2760.

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Draft Finance Bill 2016 Restricted Stock Units

Uk Investment Tax For Employees Selling Rsus Taxscouts

Rsu And Taxes Restricted Stock Tax Implications

Uk Investment Tax For Employees Selling Rsus Taxscouts

![]()

Rsu Uk Losing 72 To Tax And Ni Moneysavingexpert Forum

![]()

What The Heck Is An Rsu And What Do I Do With Mine And How Is It Different From A Bonus The Planning Center

Baker Mckenzie Llp Is An English Limited Liability Partnership And Is A Member Of Baker Mckenzie International A Swiss Verein With Member Law Firms Ppt Download

Uk Investment Tax For Employees Selling Rsus Taxscouts

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Uk Investment Tax For Employees Selling Rsus Taxscouts

Baker Mckenzie Llp Is An English Limited Liability Partnership And Is A Member Of Baker Mckenzie International A Swiss Verein With Member Law Firms Ppt Download

2021 Capital Gains Tax Rates In Europe Tax Foundation

When Do I Owe Taxes On Rsus Equity Ftw

Restricted Stock Units Jane Financial

Sec Filing Rewalk Robotics Ltd

Rsus A Tech Employee S Guide To Restricted Stock Units